HELOC A HELOC can be a variable-level line of credit score that allows you to borrow cash for just a established period and repay them later.

In order that a student doesn’t exceed the aggregate loan limitations, the scholar’s FAFSA variety information is matched with NSLDS, and if the student has exceeded or is approaching the combination loan limitations, this tends to be mentioned from the ISIR.

The father or mother of a dependent scholar is not a U.S. citizen or long lasting resident or is not able to deliver proof from your U.S. Citizenship and Immigration Support that they are in the United States for apart from A brief objective Using the intention of turning into a citizen or copyright.

Just how long it requires for getting a private loan relies upon primarily on the lender. Lots of personalized loan firms offer identical-day funding, As long as your loan is processed by a specific time of working day.

Even so, observers broadly count on Biden’s new student loan forgiveness decide to confront lawful issues, which could hold off or maybe block the program fully. The new system makes use of a wholly distinct authorized authority from Biden’s initial mass credit card debt cancellation initiative, and also the statute at situation — the upper Training Act — expressly authorizes the Education and learning Office to cancel college student personal debt in particular conditions.

Ahead of you decide on A non-public student loan lender, think about your priorities and what performs finest to suit your needs. Many lenders offer prequalification, which can help you compare fascination charges and phrases before selecting. Consider comparing 3 to five unique lenders employing the following options:

support in plans that Incorporate undergraduate and graduate research, which include courses that direct only to some graduate or Qualified degree, but may possibly acknowledge students who usually do not still fulfill the regulatory specifications to get deemed graduate or Specialist diploma college students.

LendingTree’s consumer-pleasant Web page provides clear information on its lenders’ present starting yearly share costs, in addition to comprehensive information on loan conditions, amounts, and minimum amount credit rating rating needs.

Loans are offered to Indiana residents only. Borrowers needs to have a FICO score of 670 or greater, a thirty% maximum financial debt-to-money ratio or minimal every month revenue of $three,333, continual employment in excess of two decades, and no significant collections or defaults lately. Borrowers who don't meet up with money or credit needs can implement which has a cosigner.

Among the finest ways to economize on college student loans is always to reduce the sum you borrow. You are able to do this by applying for grants and scholarships, Functioning even though in class and using your financial savings.

On line lenders supply advantage and speed. It is possible to utilize and receive your money on the web from any where (we suggest you use a safe WiFi relationship). A further perk: Some pass on their overhead Price tag cost savings to borrowers and usually tend to provide minimal-curiosity private loans with less service fees.

Forgiveness for a function of any IDR approach developed by the Division is at present enjoined. This features the Conserve (formerly REPAYE), PAYE, and ICR repayment options. Borrowers who attain their prepare’s repayment milestone—that is certainly, twenty five many years in repayment for borrowers on any of those options or twenty years for borrowers in PAYE or undergraduate-only borrowers in SAVE—might be moved into an fascination-no cost forbearance, if they are not presently in the forbearance on account of the litigation.

In some instances, a scholar who Earlier gained undergraduate and graduate levels returns to highschool to finish a 2nd undergraduate software. Just the loans that the coed acquired here for the main undergraduate plan are included in deciding the coed’s remaining eligibility for loans for the next undergraduate plan, up towards the undergraduate aggregate limits.

Loan volume: Not each and every personal student lender presents precisely the same quantities. Most will authorize enough to go over you up towards your school’s expense of attendance, but that’s not often the case. Furthermore, some lenders have lifetime restrictions. Evaluate lenders to determine if you're going to get the amount you will need.

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Shannon Elizabeth Then & Now!

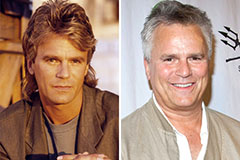

Shannon Elizabeth Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!